How to connect bank account to experian boost images are ready in this website. How to connect bank account to experian boost are a topic that is being searched for and liked by netizens today. You can Find and Download the How to connect bank account to experian boost files here. Find and Download all royalty-free photos and vectors.

If you’re searching for how to connect bank account to experian boost images information connected with to the how to connect bank account to experian boost keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

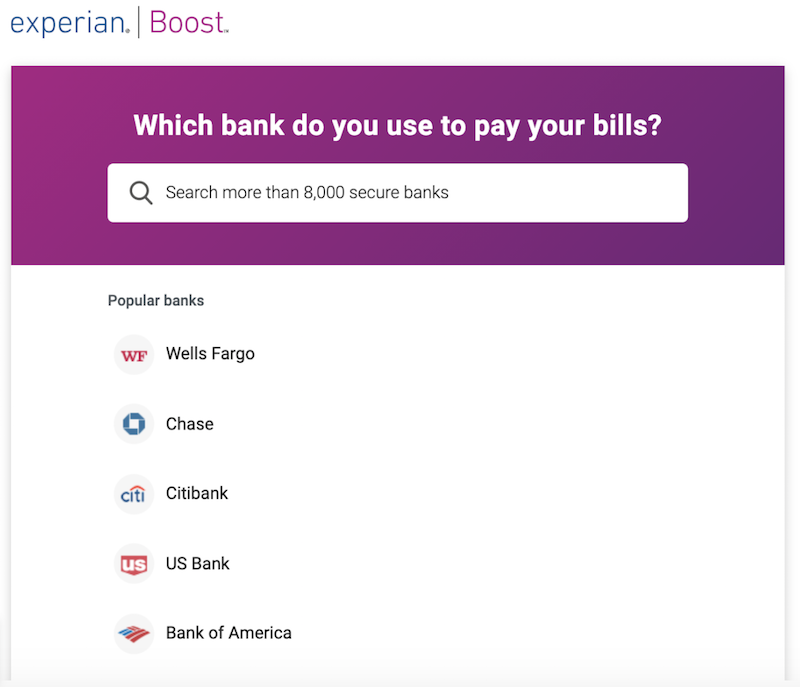

Please note that there are some account types we cant connect. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. 3 See your boost results instantly. Boost is dynamic and will be updated regularly. Your information remains private.

How To Connect Bank Account To Experian Boost. 3 See your boost results instantly. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. 2 Choose and verify the positive payment history you want added to your credit file. That means your boost can also go up or down while connected.

Westpac Banks Logos Icons Red Shops Retail Online Finance Logo Banks Logo Logos From pinterest.com

Westpac Banks Logos Icons Red Shops Retail Online Finance Logo Banks Logo Logos From pinterest.com

To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. Please note that there are some account types we cant connect. That means your boost can also go up or down while connected. Experian Boost is designed to help as many people as possible. 1 Connect the bank accounts you use to pay your bills. With Experian Boost those payments could improve your credit scores when you give Experian permission to connect to the online bank accounts you use to pay your monthly bills.

Experian Boost scans the bank account.

Boost is dynamic and will be updated regularly. 1 Connect the bank accounts you use to pay your bills. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. 2 Choose and verify the positive payment history you want added to your credit file. For example things that could cause your boost to decrease can include stopping regular payments to a savings account ending digital entertainment subscription payments for the likes of Netflix and any change in the amount of money coming in or going out of your account. Please note that there are some account types we cant connect.

Source: in.pinterest.com

Source: in.pinterest.com

1 Connect the bank accounts you use to pay your bills. With Experian Boost those payments could improve your credit scores when you give Experian permission to connect to the online bank accounts you use to pay your monthly bills. That means your boost can also go up or down while connected. Experian Boost has to connect to an existing credit file including personal information and data reported by lenders that confirms your identity. Experian Boost is designed to help as many people as possible.

Source: ar.pinterest.com

Source: ar.pinterest.com

That means your boost can also go up or down while connected. With Experian Boost those payments could improve your credit scores when you give Experian permission to connect to the online bank accounts you use to pay your monthly bills. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. That means your boost can also go up or down while connected. Please note that there are some account types we cant connect.

Source: ro.pinterest.com

Source: ro.pinterest.com

3 See your boost results instantly. Experian Boost scans the bank account. With Experian Boost those payments could improve your credit scores when you give Experian permission to connect to the online bank accounts you use to pay your monthly bills. Experian Boost has to connect to an existing credit file including personal information and data reported by lenders that confirms your identity. 2 Choose and verify the positive payment history you want added to your credit file.

Source: pinterest.com

Source: pinterest.com

2 Choose and verify the positive payment history you want added to your credit file. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. 2 Choose and verify the positive payment history you want added to your credit file. Boost is dynamic and will be updated regularly. 3 See your boost results instantly.

Source: keycreditrepair.com

Source: keycreditrepair.com

Experian Boost is designed to help as many people as possible. 3 See your boost results instantly. That means your boost can also go up or down while connected. 2 Choose and verify the positive payment history you want added to your credit file. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers.

Source: financebuzz.com

Source: financebuzz.com

To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. Boost is dynamic and will be updated regularly. Experian Boost scans the bank account. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. Your information remains private.

Source: creditcards.com

Source: creditcards.com

Experian Boost has to connect to an existing credit file including personal information and data reported by lenders that confirms your identity. Experian Boost has to connect to an existing credit file including personal information and data reported by lenders that confirms your identity. 1 Connect the bank accounts you use to pay your bills. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. For example things that could cause your boost to decrease can include stopping regular payments to a savings account ending digital entertainment subscription payments for the likes of Netflix and any change in the amount of money coming in or going out of your account.

Source: creditcards.com

Source: creditcards.com

1 Connect the bank accounts you use to pay your bills. Experian Boost scans the bank account. That means your boost can also go up or down while connected. Experian Boost is designed to help as many people as possible. Experian Boost has to connect to an existing credit file including personal information and data reported by lenders that confirms your identity.

Source: pinterest.com

Source: pinterest.com

Experian Boost has to connect to an existing credit file including personal information and data reported by lenders that confirms your identity. Boost is dynamic and will be updated regularly. For example things that could cause your boost to decrease can include stopping regular payments to a savings account ending digital entertainment subscription payments for the likes of Netflix and any change in the amount of money coming in or going out of your account. That means your boost can also go up or down while connected. With Experian Boost those payments could improve your credit scores when you give Experian permission to connect to the online bank accounts you use to pay your monthly bills.

Source: pinterest.com

Source: pinterest.com

That means your boost can also go up or down while connected. Please note that there are some account types we cant connect. For example things that could cause your boost to decrease can include stopping regular payments to a savings account ending digital entertainment subscription payments for the likes of Netflix and any change in the amount of money coming in or going out of your account. Experian Boost has to connect to an existing credit file including personal information and data reported by lenders that confirms your identity. That means your boost can also go up or down while connected.

Source: creditcards.com

Source: creditcards.com

To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. With Experian Boost those payments could improve your credit scores when you give Experian permission to connect to the online bank accounts you use to pay your monthly bills. Experian Boost scans the bank account. To use Experian Boost you will need a Free Experian Account and a current account with a bank or building society that supports Open Banking access for their customers. 2 Choose and verify the positive payment history you want added to your credit file.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to connect bank account to experian boost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.